A discounted cash flow (DCF) model is a financial model used to value companies by discounting their future cash flow to the present value. In this guide, we'll provide you with an overview of the components of a DCF model. This will serve as a reference tool for before or after our financial modeling course where we build a DCF model on public company.

High-Level Summary of DCF Modeling

- Research and develop an understanding of the business

- Gather historical data and calculate historical cash flows

- Project future cash flows with the unlevered free cash flow method

- Calculate terminal value

- Discount the cash flows

What is a Discounted Cash Flow Model?

A pivotal concept in corporate finance is present value: "how much is a future cash flow worth in today's dollars?". A discounted cash flow (DCF) model is a financial model used to value companies by discounting their future cash flows to the present value. When you create a discounted cash flow model, you’re answering the question, “What are the company’s future cash flows worth in terms of today’s value?” From this, we can determine the value of the entire company as well as the value per share. DCF modeling is a mix or art and science. There are some general procedures to follow, but variations in how to approach modeling a company and the assumptions that drive the model are very much an art.

Understand the Business Model

Before diving into any financial model or analysis, it is crucial to understand:

-

What does the company do and where does it operate?

-

What are its main business segments?

-

Who are its competitors and how does the company position itself?

-

How has it performed operationally and financially?

-

What is management saying about past and future performance?

-

What new initiatives are in the company's pipeline?

Financial analysts and investors can answer these questions through a variety of channels, including company financial reports, analyst research, management calls, and news outlets like the Bloomberg or the Wall Street Journal.

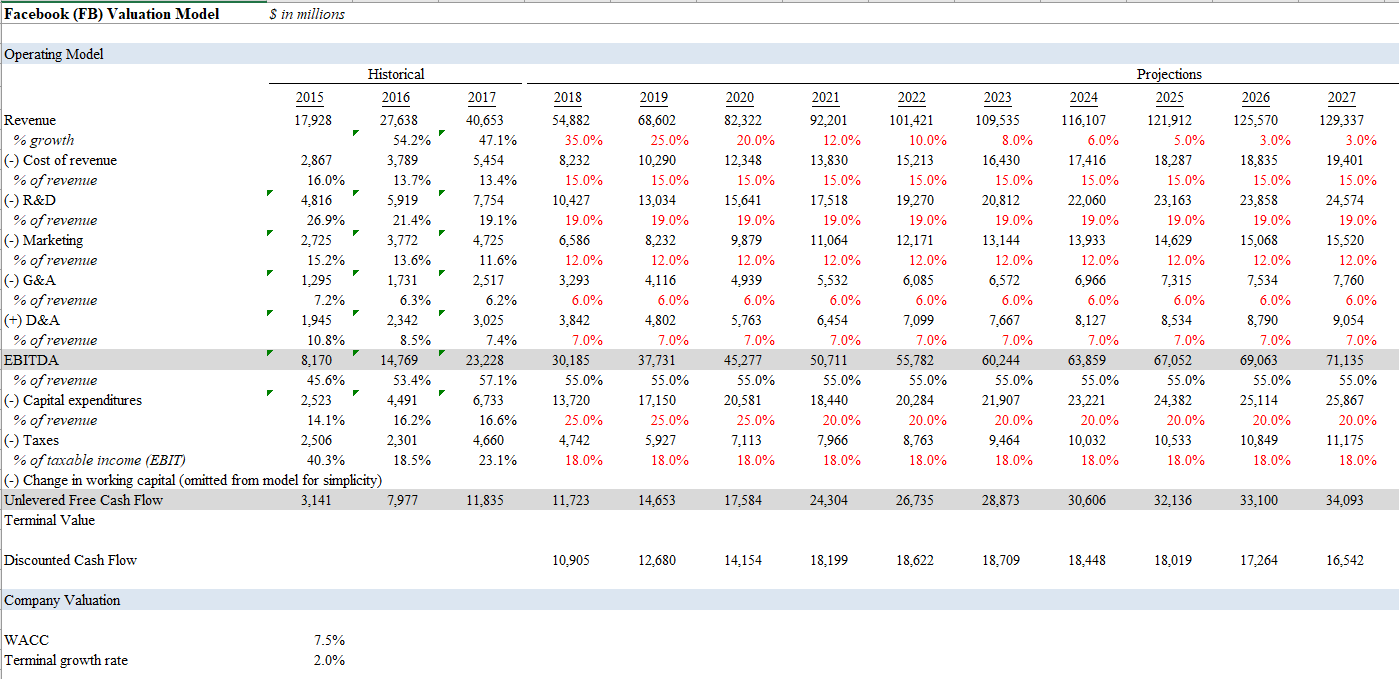

Analyze Historical Cash Flows

Once you have a good sense for the company's business model, lay out the company's historical cash flows: revenue, expenses, taxes, working capital, capital expenditures, etc. Calculate the necessary financial ratios including revenue growth rates, profit margins, tax rates, and working capital metrics. While future performance can vary significantly from the past, these historical ratios will provide us with a starting point for our financial analysis.

Project Future Cash Flows

The most popular method used for projecting future cash flows is the unlevered free cash flow method. When making our calculations, we assume the company has no leverage, or debt, such as interest payments or principal payments, to be included in projecting the future cash flows.

The unlevered free cash flow method starts with EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization). From EBITDA we subtract capital expenditures, taxes, and the change in working capital to get the unlevered free cash flow:

Unlevered Free Cash Flow = EBITDA - Capex - Taxes - Change in Working Capital

We project these cash flow items using a mix of company and industry research, management calls and commentary, analyst research, and our own opinions of future performance. This is where the "art" comes in.

Establish an Adequate Projection Period

When conducting a DCF model, the goal is to project cash flows for all future years of the company’s existence without going through any tedious, time-consuming, or unnecessary calculations. To accomplish this, we project cash flows for each year until the company reaches a steady state. A steady-state is when the company is growing at a constant rate, and all of its revenues and expenses are moving forward in proportion indefinitely.

For example, a company expects to grow out its store base over the next twelve years until it reaches the target store count. While many bankers use five or ten years as a standard projection period, to find the company’s true valuation analysts must continue the core projection period until the company reaches a true steady-state, which in this case is 12 years.

Calculate the terminal value

Since we use the company’s steady-state to project all future cash flows, we also need to calculate the company’s terminal value. In other words, what is the value of the company in the last year of the DCF model?

The terminal value of the company can be calculated in one of two ways:

- EBITDA multiple. Apply an industry multiple to next year’s projected EBITDA.

For example, EBITDA is $300 million and the industry trades at around 7x, the terminal value would be $2.1 billion.

- Gordon Growth Model. This model considers the unlevered free cash flow from the year after the final year that was established in the projection period. Divide that year’s free cash flow by the WACC (weighted average cost of capital) and then subtract the terminal growth rate. The terminal growth rate is the expected rate of all the revenues and expenses in perpetuity. That’s typically the rate of inflation.

Using one of these two methods, determine the company’s terminal value so that we can adequately discount cash flows.

Bringing it All Together: Discount the Cash Flows

Our final task is to discount each of these values to understand them in today’s terms. To do that, we need to first determine the appropriate discount rate.

When using the unlevered free cash flow method, we use the WACC (weighted average cost of capital), which considers each of the company’s components in the capital structure (e.g. debt and equity) and multiplies it by the cost of that component.

For example, a company is comprised of 50% debt and 50% equity. If the cost of equity is 8% and the cost of debt is 5%, we calculate the weighted average, 50% of 8% plus 50% of 5% to determine the WACC.

Before we are done, there is one last adjustment that we need to make! When considering the cost of debt (i.e. the interest rate on debt) we need to multiply by (1-tax rate). This is because the cost of debt is tax deductible, and companies receive a tax break directly proportional to that cost.

For example: Assume a company's tax rate is 25% and the cost of debt is 5%. The effective cost of debt would be (1 - 25%) * 5% = 3.75%.

In a separate post, we’ll discuss how to calculate the cost of equity. In short, it’s calculated using CAPM (capital asset pricing model), which is equal to the risk-free rate plus beta times the equity risk premium.

Use our Calculations to make data-driven decisions

After you project out the company’s unlevered free cash flows, and calculate the company’s terminal value, we use the WACC and discount the cash flows to today’s terms. This calculation gives us what is known as the enterprise value, or the value of the entire company. However, more often than not, we are more interested in the stock price than in this value.

To calculate stock price, we must subtract the debt and any other liabilities (such as underfunded pension liability) and then add back in any additional assets (including cash, short-term investments, marketable securities, etc.). This gives us the total equity value of the company. We can divide that value by the total number of shares to calculate the value of each share.

Once we have determined the value of each share, we can compare that value to the market’s current value (i.e. the current stock price). If the value we’ve calculated is higher than the current cost of the investment, then the investment is advisable.

Taking it one step further…

The discounted cash flow model can also be used to value private companies that don’t have publically traded equity. When a company is planning to make their initial public offering (IPO), the discounted cash flow model is one of the methods used to triangulate a value per share to sell to investors once the company goes public.

Final thoughts

The DCF model is only as good as the assumptions that analysts are able to incorporate. Analysts often spend considerable time doing the “plumbing” for their models: that is, organizing the projects, making it dynamic, doing sensitivity analysis, etc. Failure to devote adequate attention to making accurate projections will result in an insufficient valuation, regardless of the extra “bells and whistles” that may be added. Successful analyses result from spending appropriate time ensuring that the projected values are accurate and complete.

What’s next?

In our financial modeling bootcamp, we create a financial model using a real publically traded restaurant company. We’ll look at financial statements, analysts’ commentary, management commentary, and public records to project future cash flows, value the stock price, and determine whether it’s an attractive investment. Through our real-world activities, you’ll understand how the DCF model is just one component of financial modeling that you can apply to your specific professional landscape. We also offer a handful of finance classes and accounting classes to build up your finance and accounting knowledge.