Selling covered calls is a popular options strategy for generating income by collecting options premiums. In this article, we'll go through the mechanics of how it works and when it may make sense to use this strategy.

Covered Calls Summary

-

Selling covered calls is a popular options strategy for generating income by collecting options premiums.

-

To execute this strategy, you’ll need to buy (long) the stock (over 100 shares) and then write (sell) call options for that stock.

-

The strategy works best if you expect the stock to stay within a pretty tight range of prices.

Quick Options Recap

Before we jump into the covered call strategy, let’s do a quick recap of what options are. An options contract gives the purchaser the right (not obligation) to buy or sell an equity at a predetermined price and a preset date. Let’s keep simple and imagine a stock is trading at $50 per share right now. I can go ahead and buy an options contract to purchase that stock for $52 in 2 weeks from now for some amount of money. This is an example of a call option, an option that gives me the right to buy. The opposite would be a put option, which gives me the right to sell a stock.

Why Options?

Why would I want to have the right to buy a stock for $52 in two weeks if it’s trading at $50 right now? There are many reasons and cases for buying an options contract but one simple answer is that options require less cash upfront than buying the stock outright. Let’s say I think this stock is going to go up to $55 in the next two weeks, I can go buy the stock and spend $50 to make $5 in two weeks by holding the stock. I need to put down $50 to make my bet.

With options, I might only have to pay a few dollars to make that bet and if I am right I get the difference in two weeks. If I bought the options contract for $1 and then in two weeks the stock is at $55, since I own the option to purchase it at $52, I would be able to execute my option and make the $3 difference ($55-$52) and I only had to put down $1 to make the bet.

Two Notes on Options

-

Options pricing is very complicated and this is a very simplified example.

-

Also, options contracts are only sold in lots of 100 so in reality, you would have to pay $100 to make the bet, but you would make $300 in this scenario.

Buyer vs Seller

The next thing to understand is that for every transaction there is a buyer and a seller. In the example above we purchased the call option contract from someone. The seller in the example above got the $1 “premium” from us for the contract, but since the stock went up, the seller had to pay us the $3 difference so they lost money overall.

But, say our bet was wrong and the stock stayed at $50 in two weeks from now, then I wouldn’t execute my contract to buy at $52 and the contract would just expire worthless. The seller of the option sold us the contract for $1 and gets to pocket that dollar if the contract expires worthless. Now you see how someone could make money selling options contracts.

Covered Calls

Now, let’s say I own 100 shares (options work in lots of 100 shares) of the imaginary stock mentioned above and it is at $50 today. I can go ahead and sell 1 call option contract at the strike price of $52 (same as above) to someone else for $100 (100 shares x $1). When we sell a call option and we have the shares to back it up, it is called “covered” meaning that we would be able to just give up our shares if the buyer wanted to execute the option.

Like I said earlier about the seller, which is us now, we can make or lose money on this deal, depending on where the stock price is when the contract expires. We’ll give two simple example scenarios for the stock price at expiration.

-

$50: The stock stays at $50 and the contract expires worthless

-

We keep the $100 and payout nothing. $100 profit

-

We get to keep our 100 shares

-

-

$55: The stock goes to $52 and the buyer executes their option

-

We collected $100, but we also owe the option buyer the shares at $52

-

Since we own 100 shares of the stock we can just sell the shares to the buyer at $52. (Remember: when we sold the contract two weeks ago the stock was at $50 so selling it at $52 is still profitable)

-

No-brainer

At this point, you might be saying to yourself “This is a no-brainer. Either I make money selling the option contract (from the premium) or I make money selling the option contract and I make money from selling the stock for more than it was at.” Well, your assessment is somewhat correct. When you sell a covered call at a strike price above the current price, you will always collect the premium for selling the contract, and if the stock actually goes up and the contract gets executed you also get to sell your shares for more than they were at.

Not So Fast

While it seems very simple, we need to account for our old friend from economics class, the opportunity cost. The opportunity cost is loosely defined as the loss of potential gain from a different alternative. In this case, although we made $100 in premium and $200 from selling the stock ($50 to $52), the stock actually went up to $55 and if we had just held it we would have profited $500 ($50 to $55) from the surge in price.

What’s Going on Here?

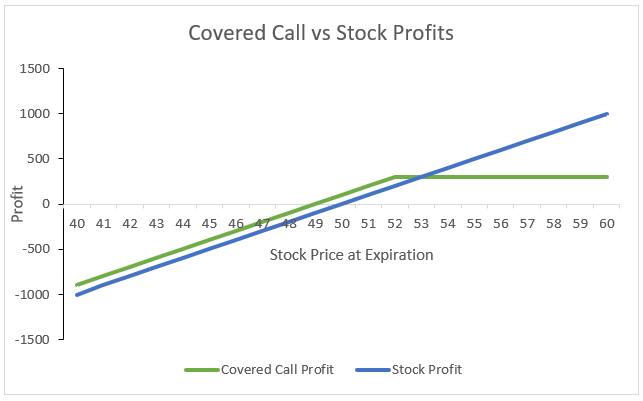

So what is actually going on here? When you sell covered calls you are essentially creating a hedge on the stock you own, thereby capping your loss, as well as your gain. If the stock goes down a lot, you at least made money on the premium and you recoup some of the loss. If the stock goes up a lot, you made money on the premium and the rise in the stock, but less than what you would have made if you just held the stock. As shown in the chart below, we have slightly less downside because we make the option premium, but our upside is capped relative to just holding the stock.

Okay, So?

So, if you understand the above, you’ll realize that the covered call strategy is best suited for an investor when they feel relatively neutral about a stock for the term of the contract, meaning they don’t believe the stock will surge or plummet by a lot over that period of time. If you have a stock at $50 and you believe it will still be at $50 in two weeks, then selling a covered call with a strike price above the current price will allow you to make money even if the stock doesn’t move.

Passive Income

Now that we’ve gone through how this works in one scenario, let’s think about this over the course of a year. Say I have this stock at $50 and I don’t really see it moving too much, so I decide to sell covered calls for two week periods for the whole year. Each time I sell the contract, I collect $100 and if the contract expires worthless then it’s all profit. If I do this over and over, I can continue to generate income with the premiums from selling calls on a stock that I already own.

Disclaimer: This strategy is not risk-free and we are not making any investment recommendation here.

Learn More on Stocks & Finance

To learn more about stocks, finance, and financial modeling and work with real examples and companies, see our related courses offerings: